Welcome to Digi, your digital finance assistant!

Created with Artificial Intelligence (AI), Digi helps you to stay on track with your expenses, looking for trends and creating ideas to improve your financial health.

Digi is not just a banking app. You are encouraged to interact and give feedback on the suggestions, refining its machine-learning process. This enables Digi to upgrade itself with new features, whenever you are ready for them.

During the onboarding, you will learn how Digi works and select your needs. If you are not experienced with micro-investment, managing several accounts or automated tasks, no worries: Digi will sort it out for you.

Try the live mock-up on your phone or discover the project’s Miro board

Digi’s main goal is to help customers to give a better approach to their money, and overcome the economic crisis with a powerful tool to monitor expenses, organise their budget and plan the future.

The main issue is to build trust on both ways: the customer must be as honest as possible with the data input, whilst Digi must protect the user’s privacy at all costs. Although this is a tough task, a robust system would be able to deliver this solution.

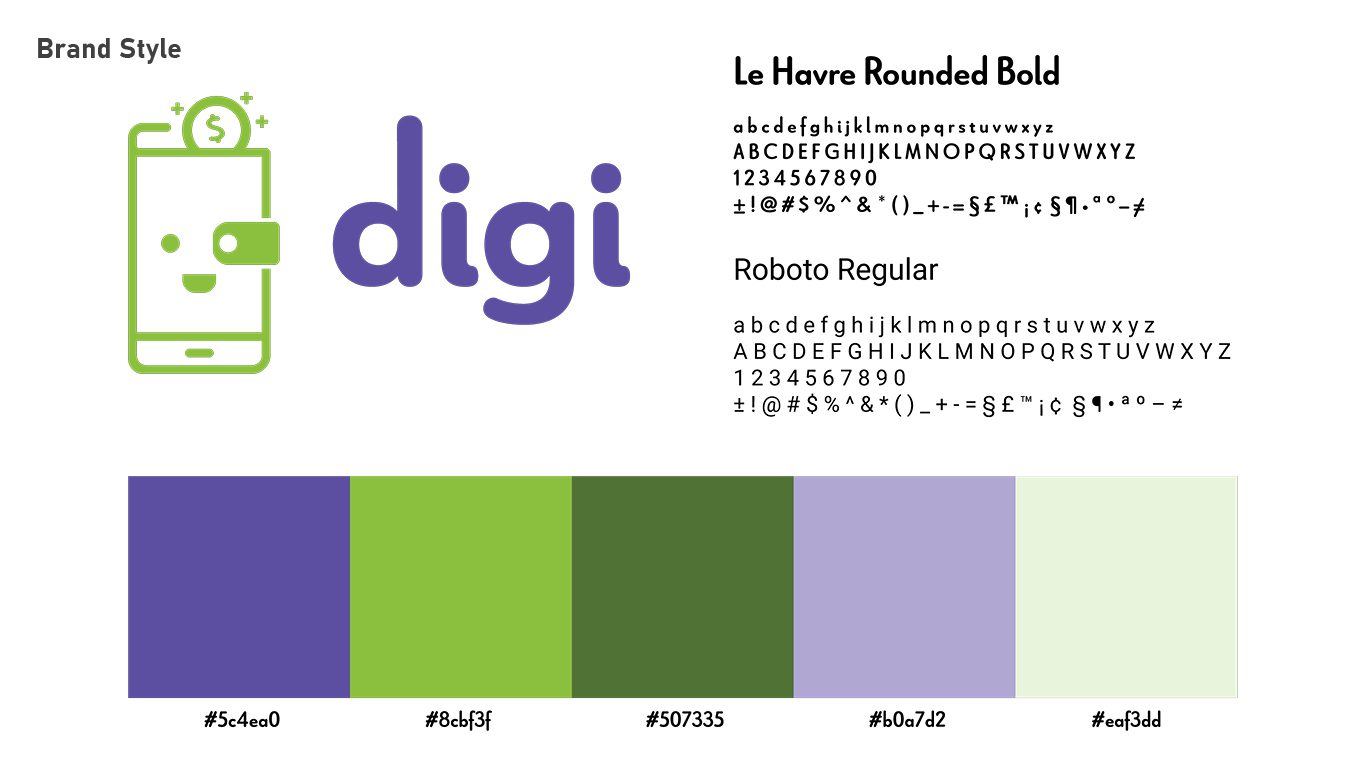

That does not mean that an AI-powered app must look bulky or too sci-fi. Digi strives for its friendly touch, introducing AI as a helpful resource to recover its customers’ financial life.

Automated tasks

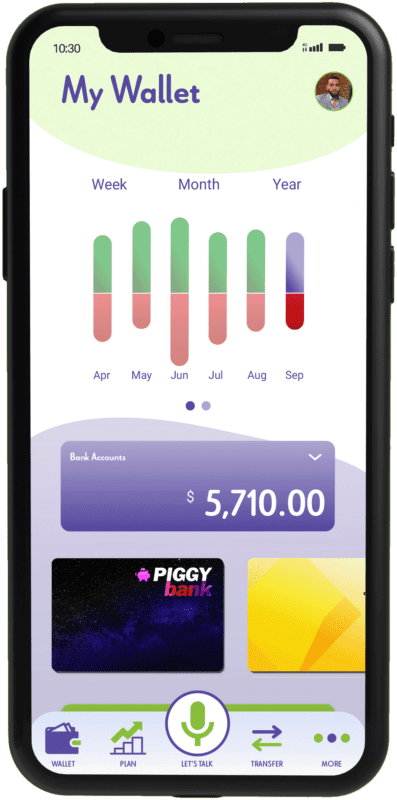

Digi understands your cashflow and is able to predict events such as payments, due bills and other regular transactions. In case something happens, just ask Digi to adapt your flow to the new scenario.

Expenses tracker

Digi tracks your expenses based on location, time and market trends. Spending too much on car maintenance? Digi will recommend you save money for a new car. Too much money on groceries last month? Divi will remind you to use a shopping list when you arrive at the store.

Planning your future

My Plan is a feature that looks into the customer’s cash flow and creates a future-proof budget. It tracks income and expenses, gives advice on over- or under-spending and helps to apply new trends as automated tasks.

Customisation and Self-Improvement

Don’t you like green and purple? It’s ok, Digi offers total flexibility to customise the menu and appearance, making it easy for the customer to access the most used features. It’s your wallet!

Another useful feature comes in the user experience evolution: not all the features are available at once, mostly because not every customer has the same level of maturity or interest in specific services, such as micro-investment, expense tracker or budget planner. Therefore, Digi will monitor the customer’s activity

and propose these services when applicable.